Retirement often marks a new chapter where simplicity, comfort, and financial freedom take center stage. For many seniors in South Carolina’s Midlands—encompassing vibrant cities like Columbia, Lexington, and Irmo—downsizing their home is a strategic move to embrace this lifestyle. Downsizing isn’t just about moving to a smaller space; it’s about crafting a life that’s manageable, cost-effective, and tailored to your evolving needs. As a mortgage broker, I am here to guide you through the financial aspects of this transition, ensuring your move aligns with your retirement goals. This comprehensive guide explores the why, how, and where of downsizing in the Midlands, offering practical tips and local insights to make your retirement move seamless.

Why Downsize in Retirement?

Financial Freedom

One of the primary reasons retirees choose to downsize is to reduce financial burdens. A smaller home in the Midlands typically means lower mortgage payments, reduced property taxes, and decreased utility and maintenance costs. According to national research, 51% of seniors downsized in their recent move, often to homes between 1,500 and 2,000 square feet. This shift can free up significant funds, allowing retirees to bolster retirement savings, travel, or support family. In the Midlands, where the cost of living is relatively affordable compared to coastal South Carolina, downsizing can amplify these savings. For instance, selling a larger home in a suburban area like Lexington and moving to a condo in downtown Columbia could yield substantial equity to fund your retirement dreams.

Simplified Lifestyle

A smaller home means less space to clean, furnish, and maintain, freeing up time for hobbies, socializing, or simply relaxing. In the Midlands, where communities like Forest Acres and Chapin offer a blend of suburban calm and urban access, downsizing allows retirees to focus on what truly matters—whether it’s exploring the Riverbanks Zoo or enjoying a leisurely stroll along Lake Murray. A minimalist lifestyle reduces clutter and stress, creating a home that’s easier to manage as mobility needs change with age.

Improved Accessibility

As we age, accessibility becomes crucial. Many seniors in the Midlands seek single-level homes or communities designed with aging-in-place features, such as wide doorways, walk-in showers, and minimal stairs. Downsizing to a ranch-style home in Irmo or a senior-friendly condo in West Columbia ensures safety and comfort, allowing retirees to maintain independence. These features are particularly important in the Midlands, where healthcare facilities like Prisma Health and Lexington Medical Center are easily accessible, supporting long-term health needs.

Emotional and Practical Benefits

Downsizing can be an emotional journey, especially when leaving a family home filled with memories. However, it’s also an opportunity to curate a space that reflects your current lifestyle and future aspirations. By letting go of unneeded possessions, retirees can create a fresh start, focusing on quality over quantity. In the Midlands, the warm community vibe and abundance of local activities make this transition exciting, as you trade excess space for new experiences.

Planning Your Downsizing Journey

Start Early and Set Goals

Begin the downsizing process well in advance—ideally months or even a year before your move. Starting early reduces stress and allows time for thoughtful decisions. Define clear goals: Are you downsizing to save money, reduce maintenance, or be closer to family and amenities? For example, if proximity to healthcare is a priority, consider areas like West Columbia, near top-rated medical facilities. If you crave a vibrant social scene, downtown Columbia’s condos offer easy access to cultural events and dining. Lisa Lee can help you assess your financial goals, from evaluating your current home’s value to exploring mortgage options for your next home.

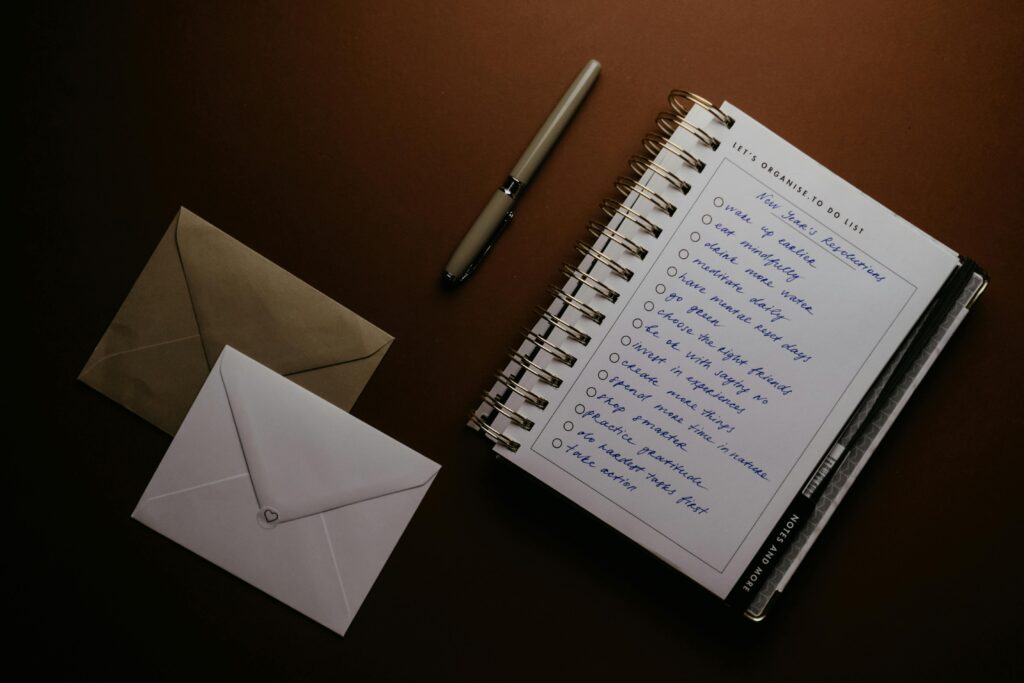

Create an Inventory and Declutter

Cataloging your belongings is a critical step. Go room by room, identifying items to keep, sell, donate, or discard. Use strategies like the “Three-Box Method” (Yes, No, Maybe) or the “6-Month Rule” (if you haven’t used it in six months, consider letting it go). In the Midlands, organizations like Harvest Hope Food Bank and Goodwill accept donations, making it easy to give items a new home. For valuable items, consider hosting a garage sale in your Columbia neighborhood or using online platforms like Facebook Marketplace. Digitizing important documents and photos can also save space while preserving memories.

Measure Your New Space

Before moving, understand the dimensions of your new home. Visit potential properties or review floor plans to determine what furniture and belongings will fit. In the Midlands, many retirees opt for condos or townhomes in communities like Saluda River Club in Lexington, which offer low-maintenance living with ample storage. Knowing your space limitations helps you prioritize essentials and avoid overcrowding your new home.

Work with Professionals

Downsizing involves multiple steps, from selling your current home to financing your next one. A real estate agent familiar with the Midlands market can maximize your home’s sale price and connect you with buyers. Lisa Lee, as your mortgage broker, can streamline the financial process, offering tailored mortgage solutions for your new home, whether it’s a condo in Forest Acres or a ranch-style home in Chapin. Professional movers specializing in senior transitions, available in Columbia, can handle packing and logistics, making the move less overwhelming.

Housing Options in the Midlands

Single-Family Homes

For retirees who want to stay in a traditional home but with less space, the Midlands offers plenty of options. Ranch-style homes in Irmo or Lexington, typically ranging from 1,200 to 2,000 square feet, are popular for their single-level layouts and low-maintenance yards. Neighborhoods like Lake Carolina in Northeast Columbia combine accessibility with community amenities like walking trails and lakeside views.

Condos and Townhomes

Condos and townhomes are ideal for retirees seeking minimal upkeep and community perks. In downtown Columbia, developments like The Gates at Williams-Brice offer modern, low-maintenance living near cultural hubs like the Koger Center for the Arts. These properties often include amenities like fitness centers and pools, fostering a social and active lifestyle.

Senior Living Communities

The Midlands is home to several senior living options, from independent living to assisted living communities. Still Hopes Episcopal Retirement Community in West Columbia provides a continuum of care, allowing residents to age in place with access to healthcare and social activities. Independent living communities like The Heritage at Lowman in White Rock offer apartments or cottages with maintenance-free living and vibrant social calendars.

Tiny Homes

For those embracing minimalism, tiny home communities are emerging in the Midlands. While more common in Upstate South Carolina, areas like Lexington are seeing interest in tiny homes under 400 square feet. These homes, often costing between $70,000 and $80,000, offer affordability and sustainability, with features like solar power and compact designs. Check local zoning regulations, as some Midlands areas have restrictions on tiny homes.

Financial Considerations with Lisa Lee

Selling Your Current Home

Selling a larger home in the Midlands can unlock significant equity, especially in high-demand areas like Forest Acres or Lake Murray. Work with a real estate agent to price your home competitively, considering the region’s stable market. Lisa Lee can help you understand how the proceeds from your sale can fund your next home or boost your retirement savings.

Budgeting for Your New Home

Downsizing typically reduces housing costs, but it’s essential to create a budget that accounts for mortgage or rent, utilities, property taxes, and HOA fees (common in condos and senior communities). Lisa Lee can guide you through mortgage options, such as fixed-rate loans for predictable payments or reverse mortgages for those 62 and older, which can provide additional income without monthly payments.

Cost Savings

A smaller home in the Midlands can lead to substantial savings. For example, moving from a 3,000-square-foot home in Irmo to a 1,500-square-foot condo in Columbia could cut utility bills by 30-50% and reduce property taxes significantly. These savings can be redirected toward travel, healthcare, or hobbies, enhancing your retirement lifestyle.

Tax Implications

Selling your home may trigger capital gains taxes, but exemptions often apply for primary residences (up to $250,000 for individuals or $500,000 for couples). Lisa Lee can connect you with a financial advisor to navigate tax implications and ensure your downsizing plan aligns with your financial goals.

Emotional and Practical Tips

Acknowledge the Emotional Journey

Leaving a long-time home can be bittersweet. Take time to process emotions by hosting a farewell gathering or creating a memory book with photos of your home. Focus on the excitement of new beginnings, whether it’s joining a book club in Columbia or exploring the Congaree National Park.

Stay Positive and Patient

Downsizing is a process that requires patience. Break tasks into manageable steps, and celebrate small victories, like clearing out a single room. Enlist family or friends for support, or hire a professional organizer in the Midlands to streamline the process.

Design Around Treasured Possessions

Your new home should feel like yours. Prioritize cherished items, like family heirlooms or artwork, and design your space around them. In a smaller Midlands condo, a gallery wall of family photos or a display of collectibles can add personality without clutter.

Why the Midlands?

South Carolina’s Midlands is an ideal retirement destination, blending affordability, mild weather, and a welcoming community. Columbia’s vibrant downtown offers cultural attractions, while Lexington and Irmo provide suburban tranquility with easy access to Lake Murray. The region’s healthcare facilities, like Prisma Health, ensure quality care, and the cost of living remains lower than in coastal cities like Charleston. Whether you choose a condo in Forest Acres or a tiny home in Lexington, the Midlands offers diverse housing options to suit your retirement vision.

Conclusion

Downsizing in South Carolina’s Midlands is more than a move—it’s a step toward a simpler, more fulfilling retirement. By starting early, setting clear goals, and working with professionals like me with my 32 years of experience as a mortgage broker, you can navigate the financial and emotional aspects with confidence. Whether you’re drawn to a low-maintenance condo, a cozy ranch-style home, or a vibrant senior community, the Midlands offers a wealth of options to make your retirement dreams a reality. Reach out today to explore mortgage solutions and start your journey to a simpler, more rewarding lifestyle.