As a mortgage broker, I’ve guided many families through the rewarding journey of buying a home in New Jersey, a state celebrated for its excellent schools, vibrant communities, and proximity to major cities like New York City and Philadelphia. Raising a family in New Jersey offers access to top-tier education, safe neighborhoods, and family-friendly amenities, but the state’s median home sale price of $538,300 (as of January 2025) can pose challenges for growing households. With careful planning and the right mortgage programs, families can find affordable homes that meet their needs. In this article, I share essential home-buying tips for families and highlight low-interest mortgage programs to make homeownership accessible. From choosing the right neighborhood to securing favorable financing, this guide will help you build a stable, nurturing environment for your family.

Why New Jersey for Raising a Family?

New Jersey is a family-friendly state with top-ranked school districts, diverse recreational opportunities, and strong job markets near urban hubs. Suburban neighborhoods offer spacious homes and safe streets, while coastal and urban areas provide cultural and outdoor activities. However, high property taxes (2.49% average) and a competitive housing market require strategic planning. I’ve helped families find homes below the state median by targeting affordable areas and leveraging low-interest mortgage programs like those offered by the NJHMFA. Below, I outline key home-buying tips, top family-friendly neighborhoods, and mortgage options to support growing households.

Home Buying Tips for Families in New Jersey

Raising a family while buying a home demands a balance of space, affordability, and long-term planning. Here are my top tips to guide families through the process:

1. Define Your Family’s Needs

Consider your family’s current and future needs—number of bedrooms, proximity to schools, access to parks, and commute times. I recommend prioritizing homes with 3–4 bedrooms (1,800–2,500 sq. ft.) for growing families and neighborhoods with strong schools and community amenities. For example, a family with young children might value a backyard and nearby playgrounds, while those with teens may prioritize access to extracurricular activities.

2. Budget Wisely

- Calculate Housing Costs: Keep housing costs (mortgage, taxes, insurance) at 28–36% of your gross monthly income. For a $100,000 household income, aim for $2,333–$3,000 monthly. For a $400,000 home, expect $9,960 annually in taxes ($830 monthly) and $1,526 yearly for insurance ($127 monthly).

- Save for Down Payment and Closing Costs: Plan for a 3–10% down payment ($12,000–$40,000 for a $400,000 home) and 2–5% closing costs ($8,000–$20,000). I suggest saving 6–12 months in advance using a high-yield savings account.

- Maintain an Emergency Fund: Budget 3–6 months’ expenses ($12,000–$24,000 for a $4,000 monthly budget) to cover unexpected costs like repairs or childcare.

3. Prioritize School Districts

New Jersey’s schools are among the nation’s best. Research districts using GreatSchools or Niche for graduation rates, test scores, and extracurriculars. I recommend targeting neighborhoods with schools offering diverse programs (STEM, arts, sports) to support your children’s growth.

4. Choose Family-Friendly Neighborhoods

Select areas with parks, community centers, and family events. I advise visiting neighborhoods during weekends to assess the vibe—look for playgrounds, safe streets, and active community groups. Proximity to healthcare and job hubs is also key for busy families.

5. Work with a Buyer’s Agent

A real estate agent familiar with family-friendly areas can find homes within your budget and negotiate deals. I suggest agents experienced in your target neighborhoods to navigate competitive markets and ensure the home meets family needs.

6. Plan for Maintenance

Family homes require upkeep (1–2% of the home’s value annually, or $4,000–$8,000 for a $400,000 home). I recommend choosing newer homes or townhomes to minimize repairs or budgeting for maintenance to avoid financial stress.

Top Family-Friendly Neighborhoods for Homes Under $500,000

I’ve selected five neighborhoods with homes under or near $500,000, offering spacious properties, top schools, and family-oriented amenities. These areas balance affordability with quality of life, ideal for raising children.

1. Toms River (Ocean County)

- Median Home Price: $400,000–$450,000

- Why It’s Great: Toms River combines coastal charm with family-friendly amenities. Single-family homes and townhomes start at $300,000, offering 3–4 bedrooms. I love the Toms River Regional School District (90% graduation rate) for its sports and arts programs. Parks like Cattus Island County Park and events like the Halloween Parade create a vibrant community. NJ Transit connects to NYC (70 miles).

- Home Example: A 3-bedroom, 2-bathroom single-family home (1,800 sq. ft.) listed at $425,000, with a fenced backyard.

- Key Amenities: Beaches, parks, and Community Medical Center.

2. Haddonfield (Camden County)

- Median Home Price: $450,000–$500,000

- Why It’s Great: Haddonfield’s top-tier Haddonfield Public Schools (95% graduation rate) offer AP courses and extracurriculars like theater. Single-family homes start at $350,000, ideal for families. I appreciate the walkable downtown with cafes and the PATCO train to Philadelphia (10 miles). Haddon Lake Park is perfect for family outings.

- Home Example: A 3-bedroom, 2-bathroom colonial (1,600 sq. ft.) listed at $475,000, with a modern kitchen.

- Key Amenities: Excellent schools, walkable downtown, and transit.

3. West Deptford (Gloucester County)

- Median Home Price: $300,000–$400,000

- Why It’s Great: West Deptford offers affordable single-family homes starting at $250,000, with 3–4 bedrooms. I find the West Deptford School District (88% graduation rate) strong for STEM and sports. RiverWinds Community Center has pools and fields, and lower taxes (around 2%) ease costs. It’s 15 miles from Philadelphia via I-295.

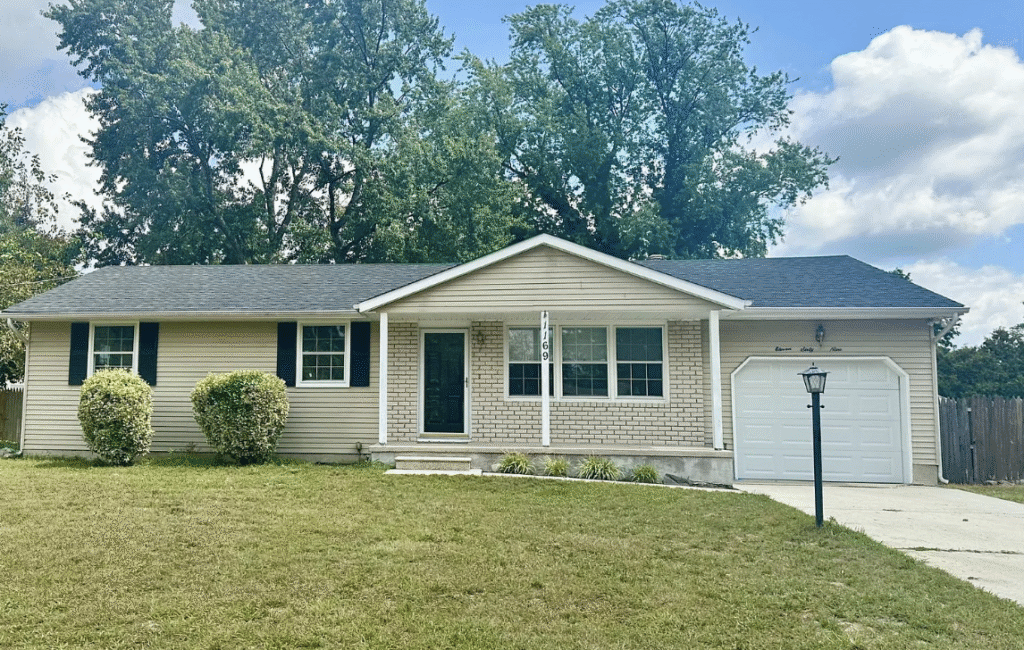

- Home Example: A 4-bedroom, 2-bathroom ranch (2,000 sq. ft.) listed at $395,000, with a deck.

- Key Amenities: Affordable homes, community center, and low taxes.

4. East Windsor (Mercer County)

- Median Home Price: $350,000–$450,000

- Why It’s Great: East Windsor’s spacious homes and townhomes start at $300,000, offering room for growing families. I admire the East Windsor Township School District (92% graduation rate) for robotics and music programs. Etra Lake Park has playgrounds, and Princeton (10 miles) adds cultural perks. NJ Transit connects to NYC.

- Home Example: A 3-bedroom, 2.5-bathroom townhome (1,700 sq. ft.) listed at $415,000, with a community pool.

- Key Amenities: Good schools, parks, and job hubs.

5. Vineland (Cumberland County)

- Median Home Price: $250,000–$350,000

- Why It’s Great: Vineland is budget-friendly, with single-family homes starting at $200,000. I find the Vineland Public School District (85% graduation rate) appealing for vocational and sports programs. The Landis Theater and farmers’ markets foster community, and it’s 40 miles from Philadelphia. Inspira Medical Center ensures healthcare access.

- Home Example: A 4-bedroom, 2-bathroom home (2,200 sq. ft.) listed at $325,000, with a large lot.

- Key Amenities: Low-cost homes, community events, and healthcare.

Low-Interest Mortgage Programs for Families

Securing a low-interest mortgage is crucial for families managing childcare, education, and other expenses. I’ve outlined the best programs and strategies to minimize costs and secure favorable terms.

1. NJHMFA Mortgage Programs

- NJHMFA First-Time Homebuyer Program: Offers low-interest, fixed-rate loans (30-year terms) for first-time buyers with incomes below county limits. Rates are often below market (e.g., 5.5–6% vs. 6.38% average in August 2025). I’ve seen families in Vineland save thousands with this program.

- Down Payment Assistance: Provides up to $15,000 as a forgivable loan for down payments or closing costs. The First Generation Down Payment Assistance Program adds $7,000 for first-generation buyers, totaling $22,000. Ideal for homes in West Deptford or East Windsor. Visit https://www.njhmfa.gov for details.

- Police and Firemen’s Retirement System Mortgage: Offers low-interest loans for eligible public safety workers, applicable in any listed neighborhood.

2. FHA Loans

- Overview: Require 3.5% down ($14,000 for a $400,000 home) with a 580+ credit score. I recommend FHA loans for families in Toms River or Haddonfield, as they allow lower credit scores and competitive rates (around 6% in August 2025).

- Benefits: Lower upfront costs and flexible debt-to-income ratios suit families with childcare expenses.

3. Conventional Loans

- Overview: Offer 3% down ($12,000 for a $400,000 home) for 620+ credit scores. I suggest conventional loans for families with strong credit in Haddonfield or East Windsor, as they often have lower mortgage insurance than FHA loans.

- Low-Interest Option: Fannie Mae’s HomeReady program offers reduced rates for low- to moderate-income buyers, ideal for homes under $500,000.

4. VA Loans

- Overview: Provide 0% down for eligible veterans and active-duty military, with competitive rates (around 5.8–6% in August 2025). I recommend VA loans for families in any listed area, especially those with limited savings.

- Benefits: No private mortgage insurance (PMI) reduces monthly costs.

5. USDA Loans

- Overview: Offer 0% down for homes in rural-suburban areas like Vineland, with low-interest rates (around 5.5–6%). I’ve seen families use USDA loans to afford spacious homes with no upfront cash.

- Eligibility: Requires income below area limits and a 640+ credit score.

6. Compare Rates and Lenders

A 0.5% rate difference saves significant costs. For a $400,000 loan, a 6% rate versus 6.5% saves $120 monthly ($43,200 over 30 years). I suggest using Bankrate to compare rates from lenders like Rocket Mortgage, Quicken Loans, or local banks. Lock in your rate when favorable to protect against rate hikes.

7. Get Pre-Approved

Pre-approval clarifies your budget and strengthens your offer in competitive markets like Haddonfield. I recommend providing accurate financials—W-2s, pay stubs, and debt details—to at least three lenders for the best terms. Pre-approval also helps you focus on homes within your price range.

Additional Tips for Families

- Explore Family Amenities: Choose homes near parks (e.g., Cattus Island in Toms River) or community centers (e.g., RiverWinds in West Deptford) for family activities.

- Plan for Future Growth: Opt for 3–4-bedroom homes to accommodate growing families, as seen in Vineland or East Windsor.

- Negotiate Closing Costs: Ask sellers to cover 2–3% of closing costs ($8,000–$12,000 for a $400,000 home) to reduce upfront expenses.

- Use Online Tools: Platforms like Redfin, Zillow, or Houzeo help filter homes by price, bedrooms, and school districts.

Final Thoughts

Raising a family in New Jersey is a rewarding experience, and buying a home in family-friendly neighborhoods like Toms River, Haddonfield, West Deptford, East Windsor, and Vineland is achievable with the right strategy. By prioritizing schools, budgeting wisely, and leveraging low-interest mortgage programs like NJHMFA, FHA, VA, or USDA loans, families can secure spacious, affordable homes. I encourage you to start with a pre-approval from a trusted lender and explore listings on Redfin or Zillow. For more on NJHMFA programs, visit https://www.njhmfa.gov. With careful planning, your family can thrive in a New Jersey home tailored to your needs.